One of the most crucial steps to closing a vacant land transaction in-house is the title search.

As a real estate investor, you need to be 100% sure that the person you're buying a property from has a clear title to the property. You need to ensure that you're getting a deed and paying the actual property owner (not somebody who thinks they own the property or is blatantly lying and claiming they own it).

Why A Clear Title Matters

When I bought my first house, the concepts behind title work and title insurance really confused me, and if you're new to real estate, it may seem confusing to you too.

In a lot of ways, it's similar to the process of buying a car.

Suppose you see a car parked in someone's driveway with a “FOR SALE” sign in the window.

The car looks nice, so you walk up to the house, knock on the door and say

“I saw this car parked in your driveway, is it yours?”

The person replies,

“No, it's not mine – but what the heck, I'll sell it to you for $20,000!”

There's obviously something wrong with this picture.

A person can't sell something they don't legally own – and while it sounds like a ridiculous example, you'd be surprised at how often I've come across situations just like this in the real estate business.

How does this kind of issue come up in the first place? There are a lot of potential reasons…

In some cases, I've met people who inherited real estate from their parents or relatives and somewhere along the way, the proper paperwork was never filed to give them the “legal right” to sell the property.

RELATED: How to Buy Real Estate from a Dead Person

I've also come across people who decided to buy properties without doing their own due diligence and then THEY ended up stuck with a property that didn't have clear title.

As weird as it may sound, a person can actually end up with their name on the tax bill (and in some cases, even on the most recent deed) – but somewhere in the historical chain of title (as recorded in the county's records) the property wasn't transferred correctly from a seller to their buyer, and even though their name is on the most recent deed, they still don't own it.

Issues Beyond Ownership

Another reason it's important to do a title search is to make sure there aren't any liens or mortgages on the property.

Especially when you're offering a property owner a very small amount of cash for their property (like I tend to do), there will be times when a seller conveniently neglects to mention that there's a $100,000 mortgage or $20,000 construction lien tied to the property.

If you fail to catch these clouds on title BEFORE you close on the deal, these issues will become your problem, along with the property itself.

When you spend enough time in the real estate business, you will inevitably run into these kinds of hiccups. Sometimes there's a quick and easy solution for getting them resolved, and sometimes there isn't.

Should You Buy Title Insurance?

Most real estate professionals (realtors, bankers, insurance agents) would like you to believe that the only way to identify these problems is to pay hundreds, even thousands of dollars for a title company to research the property for you and issue a title insurance policy.

In many cases, buying title insurance is a smart move. A title insurance policy is essentially a guarantee from a title company (which usually comes with several conditions) that your subject property's title history has been reviewed, and it is free of any liens, mortgages or other unforeseen issues (unless specifically stated otherwise). In other words – once the transaction is closed, you are the official owner of the property, and the title company will guarantee that there aren't any other hidden parties that have an ownership claim to the property.

The nice thing about using a title company (and paying for a title insurance policy) is that most title companies will be better qualified to review the chain of title an identify these hidden issues. It's literally their job to search through this kind of documentation and find these issues before you make the mistake of buying a property that doesn't have a clear chain of title.

For this reason, if you've never done your own title search and/or if you simply don't have the time or attention span to sift through this kind of documentation, a title company is probably the best option for you. A title insurance policy will give you a solid layer of protection and can save you time and bring peace of mind – knowing that the process was done right (or at least, you'll have someone to fall back on if any mistakes were made).

RELATED: How to Read a Title Insurance Commitment

That being said… when you're buying a parcel of vacant land for $150 (something I see quite often in my line of work), can you really justify paying another $450 just for a title insurance policy, thereby tripling your cost to purchase the property?

Is it worth paying more for a title insurance policy than for the property itself?

Where should you draw the line??

How do you keep these costs from eating away your profit margin on smaller deals like this?

Title Research – The Cheap Way

There is a way to make this process MUCH less expensive, and significantly faster – though it will require more time and effort on your part.

The way I handle this is to order an “abstract of title” from a local title agency or a professional abstractor (oftentimes, abstractors are the people a title company will hire to pull these records for them).

Abstractors can be found a few different ways.

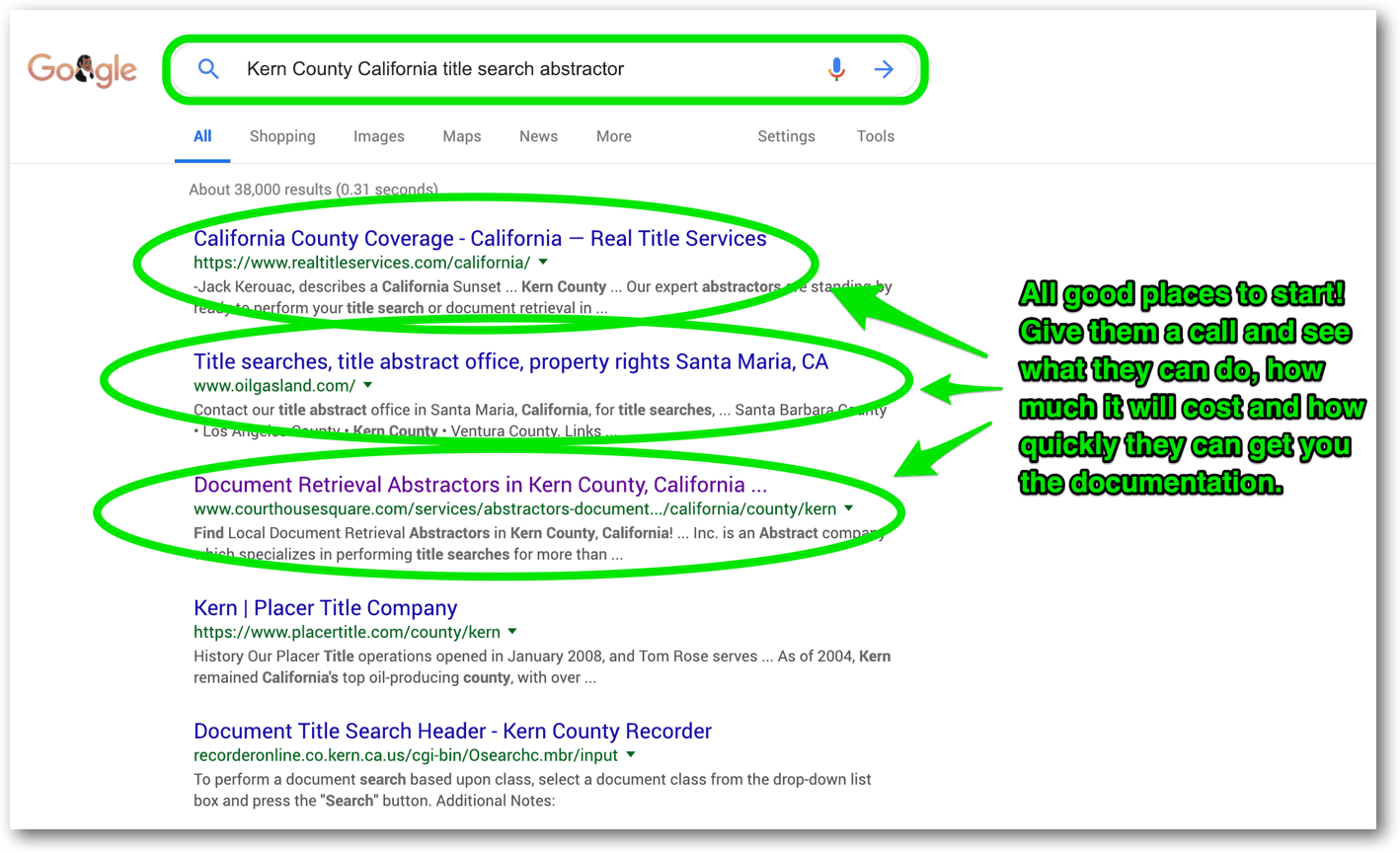

One way is to do a simple Google search for something like:

“County Name” “State” “title search” and “abstractor”)

and see if you're able to find any local professional abstractors.

You can also call the County Recorder's office (aka – Register of Deeds) and ask if they have any recommendations on who can pull a title search for you.

I've found that most Recorder's offices have all kinds of connections and can help you find different abstractors at a very reasonable price.

Another option is to call your title insurance agency and ask them to pull a title search on the property (this is NOT the same thing as a title commitment). Most title companies will charge more for the same work (because this is one of the few ways they make money), so this may not be the cheapest way to go, but they can almost always help you.

You can also find professional abstractors who will do this kind of work anywhere in the country. Companies like ProTitleUSA and even some contractors on Fiverr may be able to bridge the gap and make the process even easier for you.

The price for an abstract of title will vary depending on who you talk to, and sometimes you'll want to get prices from a few different sources before you pull the trigger.

In my experience, the cost is usually somewhere in the vicinity of $75 – $125 for this service (if the cost gets over-and-above $150, I'd recommend looking elsewhere). It will usually take the abstractor a couple of days (sometimes longer) to pull together a full list of the historical records on that property. Once you get the records back from them, it's just a matter of examining each individual deed on record AND making sure there are no mortgages or liens hidden throughout.

When you get your abstract of title, the order of documents will typically be laid out chronologically, from the most recent to the oldest record. If done correctly, this should make it easy for you to verify that the order of ownership looks like this:

- Owner A conveyed the property to Owner B

- Owner B conveyed the property to Owner C

- Owner C conveyed the property Owner D

…and so on throughout the history of transfers.

For example, if John Doe sold the property to Sam Smith in 1977, then the next deed on record should show Sam Smith as the seller.

If on the other hand, you saw that the next deed on record was Jane Doe selling the property to Jim Jones in 1988 (skipping over any mention of when Sam Smith sold the property to Jane Doe), this is a major red flag. It's called a “break in the chain of title”, and if a title company sees this in their research, they would NOT be able to issue their title insurance policy because there is a clear blemish in the historical records. Until this gap in the chain of title is fixed (ideally, with a deed that shows the property being transferred from Sam Smith to Jane Doe), nobody mentioned after Sam Smith has clear ownership to the property.

If you come across one of these situations, it's worth asking the seller if they have any of these original missing documents in their files. If they do, you can ask them to get those documents recorded (or you can obtain the documents directly and do it yourself) and it may be sufficient to resolve the issue.

In most cases, when I've seen a significant issue in a title search, we will ultimately walk away from the deal. It isn't fun (because at that point, we've already invested time and money into the title search), but it's A LOT better to be aware of these problems and avoid them than to ignore them and end up with a property that we never actually owned (because the seller never had the legal right to sell it in the first place).

RELATED: The State by State Guide to Real Estate Closing Agents

Knowing When It's Worth The Price

Admittedly, doing your own title search will open you up to some risk.

There is always the possibility that you will miss a crucial piece of information along the way.

These days, I try to avoid doing my own title searches for a few reasons:

- Even though I can do them faster then most title companies will, it still chews up a lot of my time.

- There is always the possibility that I'll miss a small detail that a title company would have caught.

- Most of the deals I pursue have more than enough value (and profit margin) to justify the extra cost of hiring a title company to handle this job for me.

The only time I ever do my own title search is when the market value of the property is less than $5K (I'm talking about some very cheap, “rinky-dink” properties). As soon as I start dealing with properties that are worth more than $5,000, a full-blown title insurance policy is more than worth the cost.

There's something to be said for making sure this job is done right and (more importantly) someone else is on the hook for any mistakes. This goes a LONG way towards my peace of mind (and to me, that's worth a lot).

The post How To Do Your Own Title Search appeared first on REtipster.

from REtipster http://bit.ly/2TTqIuw

No comments:

Post a Comment